Credit Sesame

Leading brand and growth creative across product, marketing, and lifecycle

When I joined Credit Sesame, the company was an early innovator in credit management with 15M registered users, but the brand no longer reflected its scale or ambition.

Creative was fragmented across acquisition, product, and lifecycle. The visual language felt flat and purely functional. High-spend paid media drove traffic into an experience that lacked emotional resonance and trust amplification.

Visually and strategically, the brand lacked cohesion. Paid ads, landing pages, product UI, and CRM operated as separate systems. Trust signals were inconsistent. Creative fatigue was high. Conversion continuity was weak.

The opportunity was not only aesthetic. It was structural.

Rewriting the narrative before redesigning the brand

Before redesigning a single asset, we rebuilt the narrative architecture of the brand.

At its core, Credit Sesame needed more than a visual refresh. It needed a unifying story that reframed credit from a transactional metric into a personal growth journey.

Fintech often defaults to institutional authority or over-optimistic hype. We rejected both. Instead, we designed a voice built on clarity, optimism, and earned trust.

Using a Storynomics framework, we defined the brand’s strategic DNA, including:

A mission centred on empowering members to unlock their full credit potential

Core values rooted in simplicity, transparency, and forward progress

A personality that was clear, conversational, trustworthy, empathetic, and inclusive

Practical writing principles that ensured consistency across product, marketing, and lifecycle

This narrative system became the connective tissue of the company. Every touchpoint moving forward reinforced partnership over authority, clarity over complexity, and progress over perfection.

With the foundation in place, we translated strategy into a scalable visual system.

Designing a dimensional identity built for scale

Our goal was to create a trust-first creative architecture capable of supporting millions of members and enterprise-level growth.

We replaced the dated flat illustration style with a proprietary 3D visual language that was warm, modern, and instantly recognizable.

Hundreds of custom 3D icons

Modular design built for rapid iteration

Paired with a functional flat UI system for clarity and performance

This system increased memorability while enabling high-volume creative testing across paid and product environments.

Shifting from product marketing to goal-state storytelling

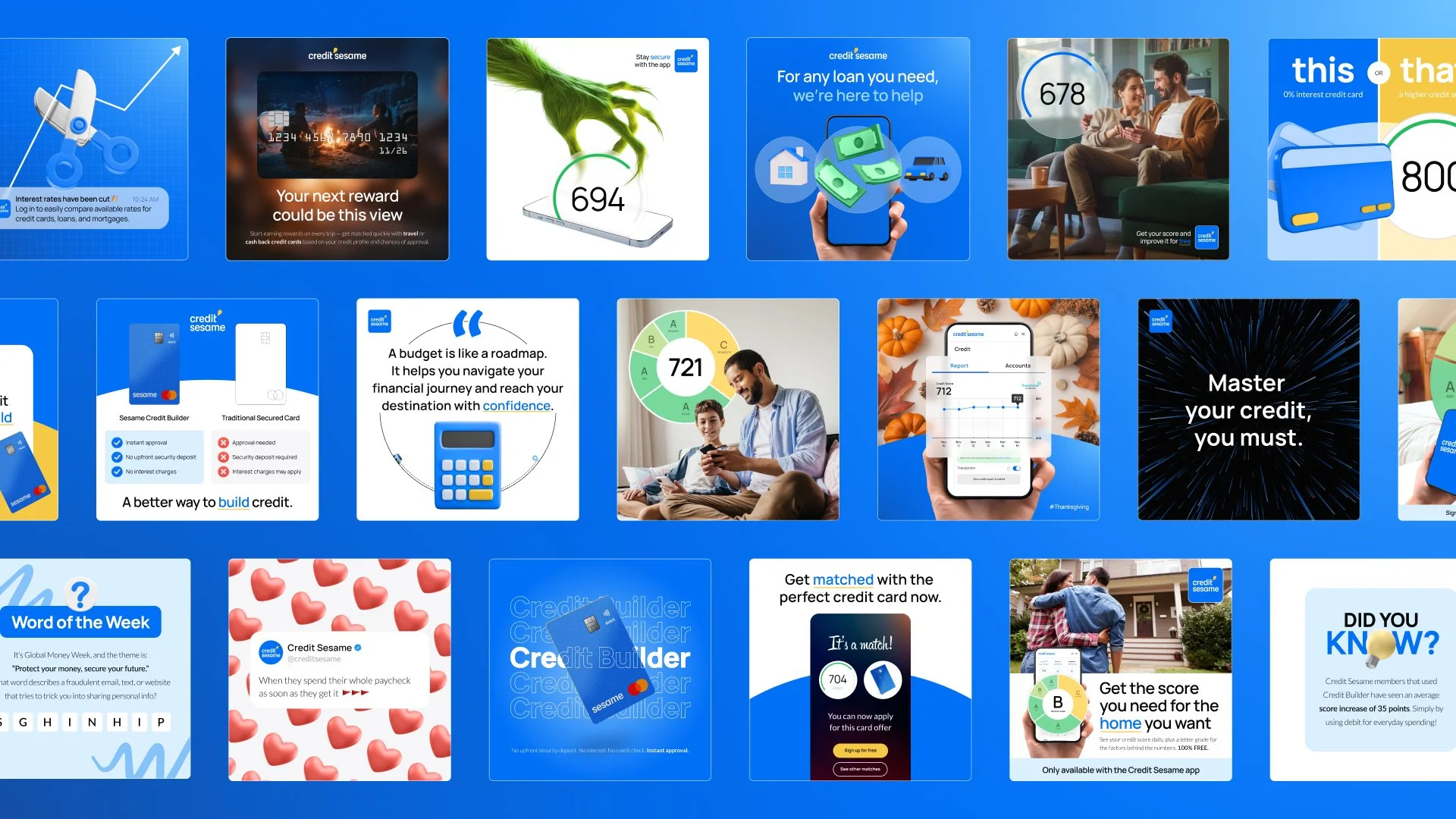

We shifted the brand from explaining credit mechanics to visualizing life outcomes.

Instead of marketing a tool, we showcased what credit unlocks: home ownership, financial stability, and peace of mind.

A curated lifestyle photography system reinforced aspiration while maintaining credibility, elevating the emotional tone across web, paid, and broadcast.

Turning brand into infrastructure

To ensure durability at scale, we established:

A modern typographic hierarchy

An accessible web color system

Modular layout frameworks

Cross-channel governance standards

Brand became infrastructure — consistent, scalable, and performance-ready.

Activating across the funnel

With the system built, we deployed it across every major touchpoint, creating cohesion from first impression to retention.

Extending the story to national broadcast

We extended the refreshed identity into national broadcast campaigns.

Cinematic storytelling aligned with goal-state positioning

Consistent assets and tone

Reinforced category authority at scale

Broadcast elevated brand perception beyond performance marketing and positioned Credit Sesame as a modern financial partner.

Rebuilding the website as the brand anchor

We redesigned the public website to reflect the new trust-first positioning and modern visual identity.

Elevated perception through cohesive storytelling

Strengthened trust signals and clarity in conversion paths

Scaled to 1M peak monthly views

The web experience became the central brand anchor, seamlessly connected to paid and lifecycle.

Scaling acquisition with a modular growth engine

We defined a modular system that supported $1M+ in monthly media spend and 650K annual conversions.

High-volume creative production

Reduced fatigue through asset combination

Clearer acquisition to product continuity

Performance improved because the brand system was built for velocity.

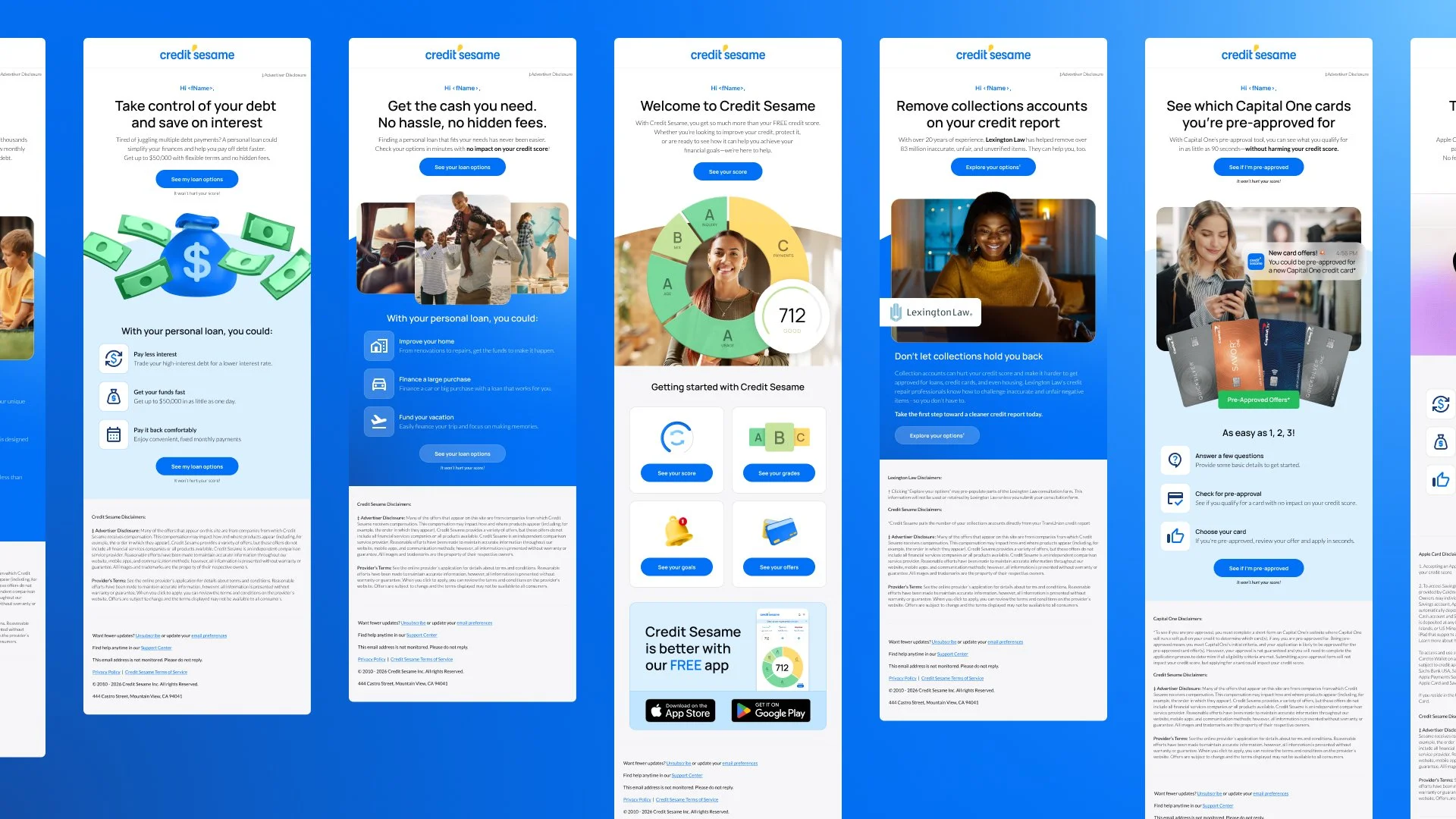

Transforming lifecycle into a revenue lever

We evolved CRM from batch messaging to intent-based journeys.

70M emails deployed daily

Contextualized offers aligned to user behavior

$60M in annual revenue attributed to CRM

Retention became a strategic growth lever, not an afterthought.

From brand refresh to growth engine

What began as a brand overhaul became a unified growth engine.

Before: a respected but utilitarian credit management product.

After: a cohesive, trust-led financial platform that grew from 15M registered users to a 19M+ member community

Preparing the business for long-term stability

The free credit model was inherently cyclical, influenced by interest rates, lending demand, and broader economic conditions. Revenue could rise and fall with market shifts. To build long-term stability, the business needed a predictable, recurring revenue stream.

We saw an opportunity to evolve from a free utility into a value-driven membership ecosystem.

Sesame+ was designed to deepen trust, expand value, and create durable revenue.

The brand foundation made it possible. Sesame+ made it sustainable.

Explore Sesame+ (coming soon)